About the study

Australia’s competitive labour market is motivating employers to actively seek out new ways to retain current employees while attracting new candidates. Novated leases are an employee perk that has seen significant growth in 2023.

A novated lease is a three-way agreement whereby an employer, employee and novated lease provider agree to a novated lease, a form of car finance. It enables employees to salary package a vehicle, with the lease payments and running costs (including fuel, servicing and insurance) paid from their pre-tax pay. When the lease ends, the employee can pay the balance to own the car or switch to a new car and only pay the difference.,

Metro commissioned a survey of an independent panel of 204 Australian business directors and decision-makers to explore business attitudes about novated leases as an employee attraction and retention tool. Metro also aimed to find out the businesses’ understanding of novated leases by asking them to select a statement they believe best describes a novated lease.

The survey spanned the full spectrum of SME owners. They included micro (1-15 employees), small (16-50 employees, medium (15-200), and large-sized businesses (more than 200 employees).

The survey respondents matched the geographical and population spread of the Australian population.

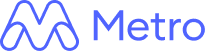

Metro also analysed its own novated lease settlement data between October 2022 and November 2023 to gauge the growth in this type of car financing in the last year.

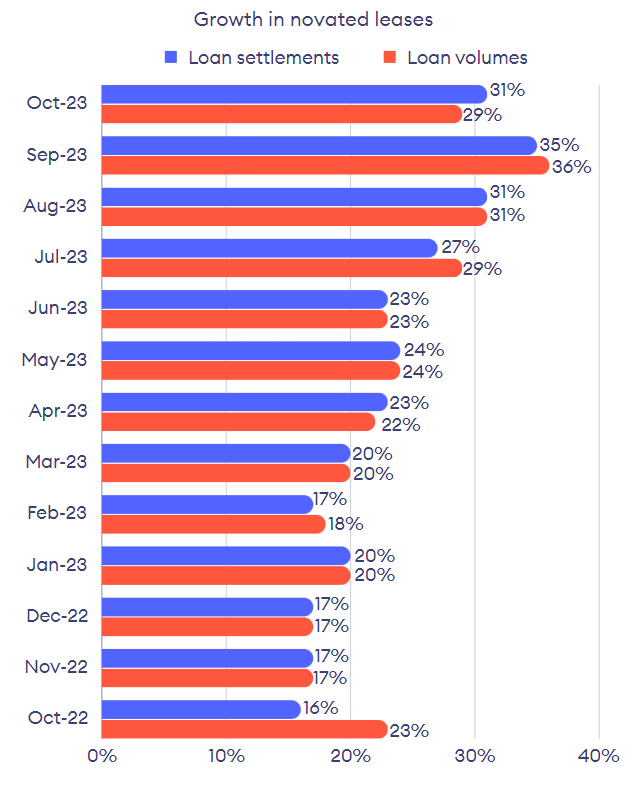

Added to the analysis was Metro’s ranking, with percentage growth figures, of the vehicle brands that are most popular among businesses in novated lease arrangements.

Growth in novated leases in 2023

Metro’s own data reveals that novated leases are growing in popularity despite being a recent addition to its service offerings. From October 2022 to November 2023, Metro reported a , with novated leases making up more than a quarter (26%) of all Metro car loan settlements.

Novated lease settlements as a percentage of all car loan/lease settlements grew from 16 per cent in October 2022 to 31 per cent in October 2023 (15% YOY increase). The proportion of novated leases reached a peak of 31 per cent in the 2023 September quarter – a 14.4 per cent increase from the 2022 December quarter.

September 2023 saw the highest proportion of novated lease settlements, peaking at 35 per cent, followed by 31 per cent in October and August 2023.

The proportion of novated leases by lease volumes (amount financed) peaked in the September 2023 quarter, hitting 32 per cent – up from 16 per cent in the December 2022 quarter. September 2023 saw the biggest novated lease volumes at Metro, at 36 per cent.

Novated leases for electric vehicles see the biggest growth

Metro also analysed the brands that are most popular for novated lease arrangements in 2022 and 2023, comparing active loans across the two years. Thanks to Federal and State Government incentives for electric vehicle purchases, Tesla is leading the charge, with Metro reporting a 22 per cent increase in Teslas financed under novated leases in 2023.

BYD and MG, also well-known for electric cars, experienced a 4 per cent and 3 per cent growth this year for novated leases, respectively.

Novated leases under Kia, Mitsubishi and Subaru also declined by 2 per cent, while novated leases for Hyundai vehicles remained the same, at 6 per cent.

Ford and Mazda experienced a 1 per cent decrease in active novated leases from 2022.

Business sentiment on novated leases helping them retain and attract employees

The increase of novated leases over the past year is only projected to rise with more companies predicted to acquire employee perks and take advantage of government incentives into creating an economy and environment that fosters the growth of electric vehicles.

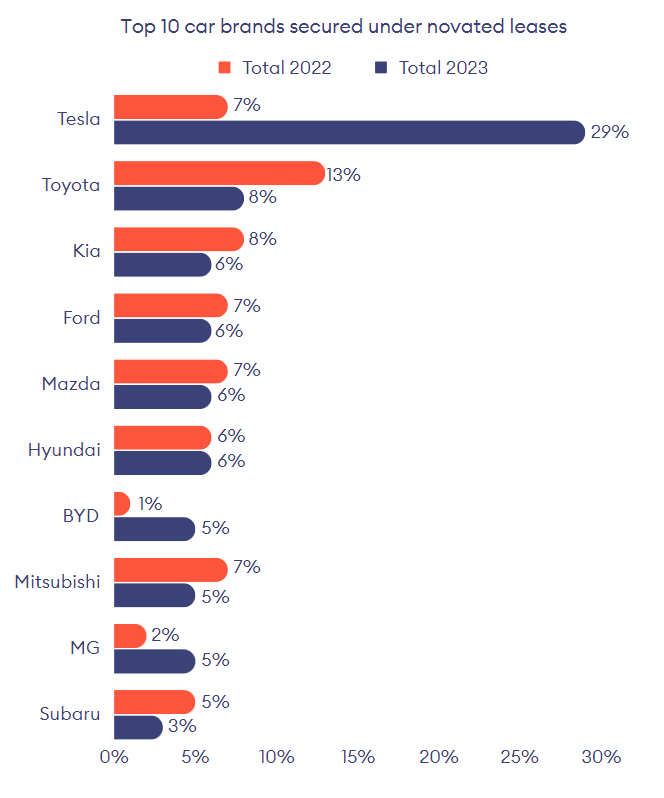

In its survey of 204 Australian business directors and decision-makers, Metro sought to discover how many businesses believe that offering employees or new candidates novated leases through a salary sacrifice arrangement would help attract new talent and retain existing employees.

Respondents could select from one of the answers below:

- Yes, I think a novated lease would help to retain some existing employees

- Yes, I think a novated lease would help to attract new employees

- No

The data revealed 70 per cent of businesses believe a novated lease would help staff retention alongside attracting new candidates, while only 30 per cent stated otherwise.

More specifically, 44 per cent of businesses believe that a novated lease would help to retain

some existing employees, while a quarter (26%) believe that a novated lease would help attract new candidates.

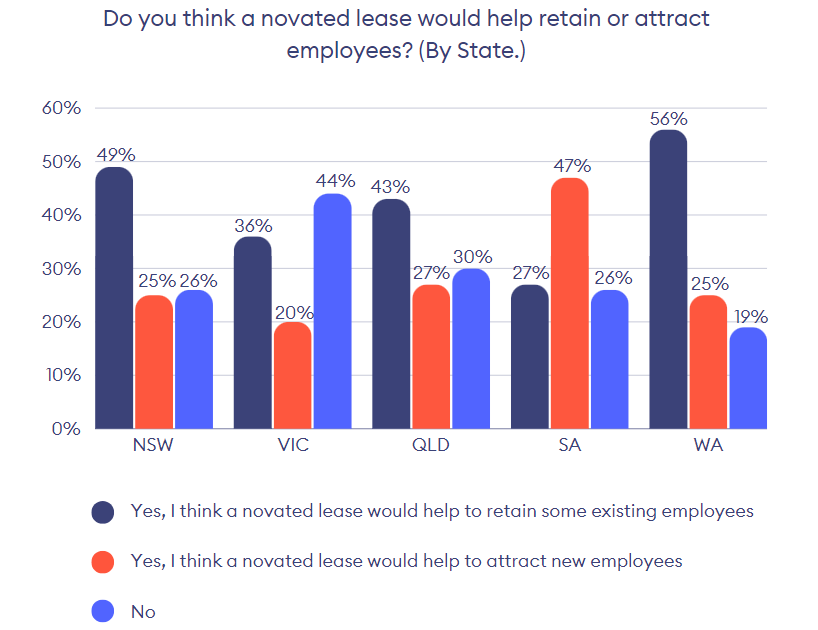

By State.

Metro found West Australian businesses have the greatest confidence in novated leases to help with staff retention and attract new employees, with 81 per cent stating so. This is followed by:

- 74% of NSW businesses

- 74% of South Australian businesses

- 70% of Queensland businesses

- 56% of Victorian businesses

More specifically, 56 per cent of WA businesses believe that a novated lease would help retain employees and a quarter (25%) believe it would help attract new candidates.

The data also revealed that businesses in SA are more likely to believe a novated lease would entice new employees (chosen by 47%).

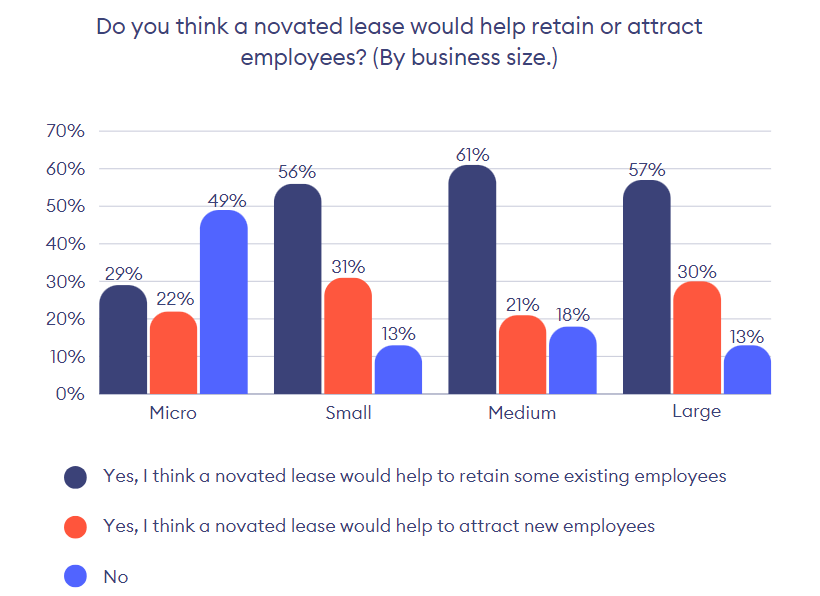

By business size.

The data reveals that small (11-50 employees) and large enterprises (more than 200 employees) are equally likely to believe that a novated lease would either assist in attracting new staff or retain current employees, with . This is followed by 82 per cent of medium-sized businesses and only 51 per cent of micro businesses.

Specifically, medium-sized businesses are most likely to believe that novated leasing would help with staff retention (chosen by 61%), followed by 57 per cent of large businesses and 56 per cent of small businesses.

However, despite the increasing popularity of novated leases and the benefits businesses believe it has on staff retention and recruitment, the survey also found that businesses still need more education around novated lease arrangements.

More than half of businesses don’t understand novated leases

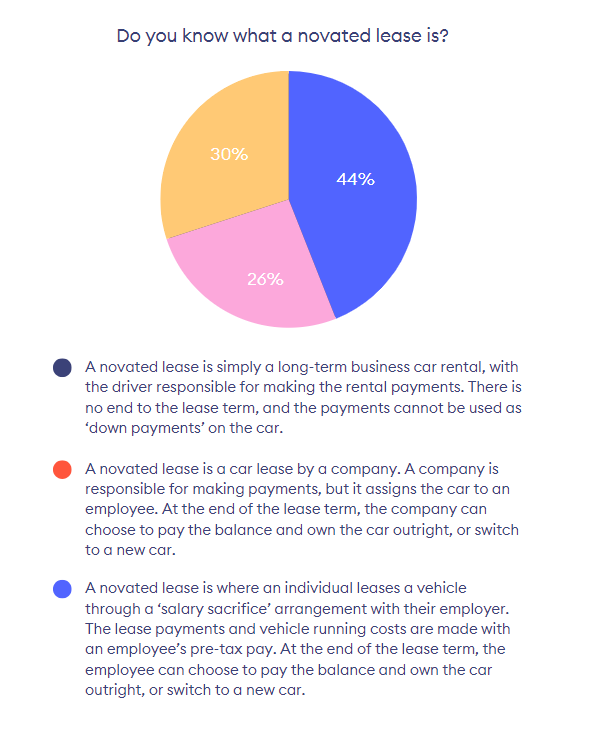

Metro sought to find out how many Australian businesses understand what a novated lease is. Metro asked respondents to choose the answer they believe best describes a novated lease, from the options below. The last option is the only true answer:

- A novated lease is simply a long-term business car rental, with the driver responsible for making the rental payments. There is no end to the lease term, and the payments cannot be used as ‘down payments’ on the car.

- A novated lease is a car lease by a company. A company is responsible for making payments, but it assigns the car to an employee. At the end of the lease term, the company can choose to pay the balance and own the car outright, or switch to a new car.

- A novated lease is where an individual leases a vehicle through a ‘salary sacrifice’ arrangement with their employer. The lease payments and vehicle running costs are made with an employee’s pre-tax pay. At the end of the lease term, the employee can choose to pay the balance and own the car outright, or switch to a new car.

Only 40 per cent of respondents chose the correct (c) answer, leaving 60 per cent of businesses with a false or inaccurate understanding of the increasingly popular employee perk.

By State.

Across the states, Metro found that businesses in South Australia are most likely to have an accurate understanding of novated leasing, with 47 per cent selecting the correct answer. This was followed closely by businesses in Queensland (46%), Western Australia (44%) and NSW (43%). Victorian businesses are least likely to know what a novated lease is, with only 31 per cent selecting the right answer.

The data further reveals that over half (51%) of businesses in Queensland and 48 per cent of Victorian businesses believe that a novated lease is a car lease by a company whereby the company is responsible for making payments whilst assigning the car to an employee (answer B).

By business size.

Metro found that medium-sized businesses are least likely to have a correct understanding of novated leasing, with 76 per cent selecting incorrect answers (A & B).

Micro businesses are most likely to select the correct answer, with nearly half (49%) selecting answer C. This was followed by 48 per cent of large businesses, 32 per cent of small businesses, and less than a quarter (24%) of medium-sized businesses.

More than half (55%) of medium-sized businesses and half (50%) of small businesses are under the misconception that novated leases involve the company making payments towards the lease after assigning it to an employee (answer B).

Lower levels of understanding around novated leases may also lead to a small proportion of businesses being aware that they can benefit from government-backed electric vehicle subsidies, which offers thousands of dollars in rebates, fringe benefits tax, and stamp duty exemptions.

For example, zero-emission vehicles owned by Victorian residents don’t attract luxury vehicle stamp duty rates, rather they pay a flat rate of $8.40 of market value, regardless of the purchase price of the vehicle. Residents in Western Australia can also score a $3500 rebate on new zero-emission vehicles with a dutiable worth of $70,000.

On the road: Around the country for incentives for buying electric vehicles

Federally:

- Battery electric vehicles, plug-in electric vehicles don’t pay customs duties as long as they’re below the luxury car tax threshold.

- Zero or low tailpipe emission vehicles below the luxury car tax threshold are exempt from Fringe Benefits when financed under a novated lease. This places EVs more in reach of employees who wish to take out a novated lease.

NSW:

- New and used EVs cheaper than $78,000 do not attract stamp duty.

- The government’s $3,000 rebate for EVs ends on 31 December, 2023, from when it will invest more in EV charging infrastructure.

Victoria:

- Zero-emission vehicles don’t attract luxury vehicle stamp duty rates, rather they pay a flat rate of $8.40 of market value, but that is regardless of the purchase price paid.

- As well, zero and low-emission vehicles can get a $100 discount on annual vehicle registration, but this isn’t available for electric heavy vehicles nor electric motorcycles.

Queensland:

- There is a $6,000 rebate for individual buyers of new electric vehicles, and up to a $3,000 rebate for businesses. The purchase price threshold is $68,000.

- Sales of electric and hybrid vehicles save 33% on stamp duty. Find out more here.

South Australia:

- A limited number of $3,000 rebates and three years’ free registration are available for battery electric vehicles worth less than $68,750. Learn more about the program here.

Western Australia:

- This state is offering a $3,500 rebate for the first 10,000 buyers of new zero-emission vehicles with a dutiable worth of $70,000. Read the fine detail here.

Tasmania:

- Tasmania is in between offering incentives for electric vehicle buyers.

Northern Territory:

- Up until 30 June 2027, a $1,500 stamp duty discount is on offer to those buying new or used electric vehicles, fuel-cell and plug-in hybrids. It’s limited to vehicles having a dutiable worth no more than $50,000.

- Over that time frame, new and existing battery-electric and plug-in hybrid electric vehicles will enjoy concessions on registration and stamp duty. This applies to cars imported from interstate or overseas, previously registered or modified electric vehicles.

- Businesses and homeowners are eligible for a $2,500 and $1,000 rebate respectively to purchase and install an electric vehicle charger.

Australian Capital Territory:

- New and used zero-emission vehicles have two years’ free registration until June 30, 2024.

- New cars, motorcycles, utility and light commercial vehicles that are zero-emission are stamp duty exempt.

https://www.mynrma.com.au/electric-vehicles/buying/ev-incentives