About the study

METRO CAPITAL COSTS HINDER GROWTH PDF

Metro commissioned a survey of 200 business owners to find out if and why

businesses are being held back from acquiring capital assets that will help grow

their businesses further.

Metro surveyed business owners across the full SME spectrum: micro (1-15

employees), small (16-50 employees) and medium (51-200 employees), and large

sized business (more than 200 employees).

Respondents were asked whether a lack of capital assets or capital assets that are

too old, were holding their business back from growing.

Respondents were then asked to identify a cause as to why their businesses are

being held back from acquiring capital assets. The reasons presented were:

- Can’t afford it.

- Can’t get a loan.

- Don’t want to get a loan.

- Don’t want to invest in capital assets at this stage.

- The prices of equipment and vehicles have increased too much.

Respondents also had the option to say that nothing was holding them back from

acquiring capital assets or that they weren’t growing their business at this time.

The survey respondents matched the geographical and population spread of the

Australian population.

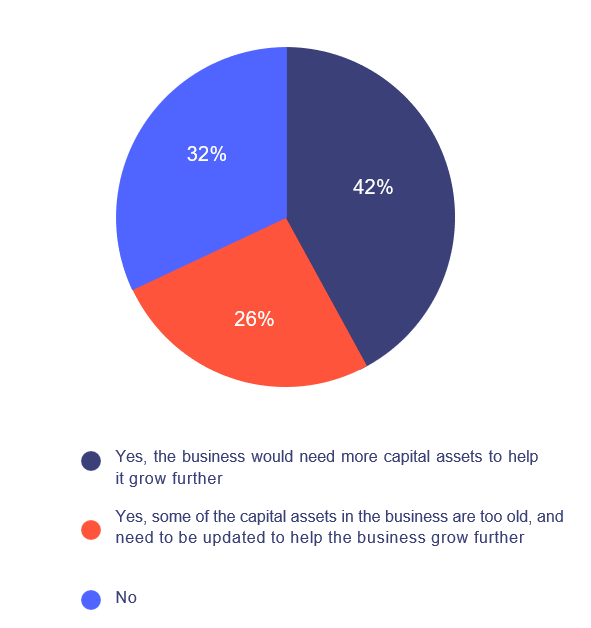

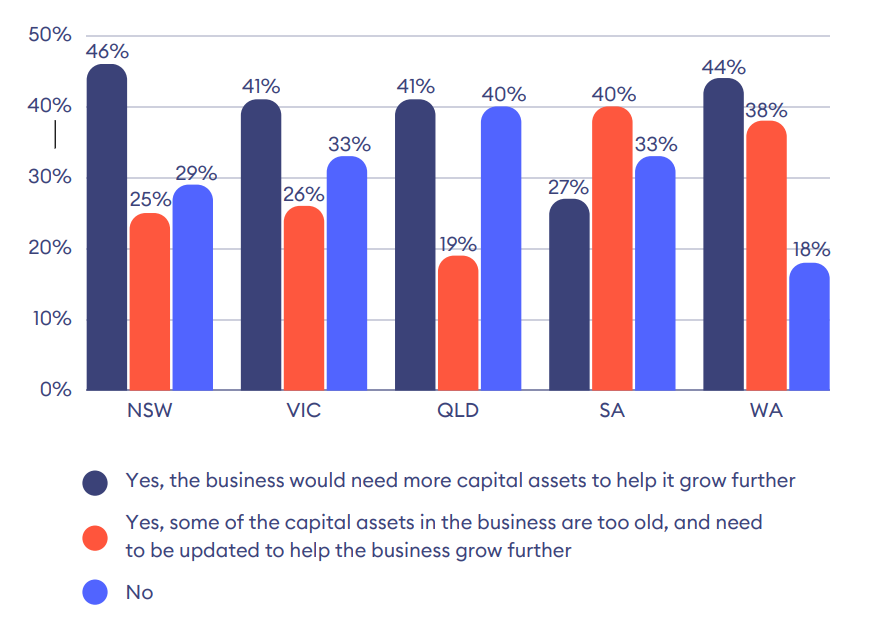

Is a lack of capital assets holding businesses back?

Two thirds of business owners admit that a lack of capital assets or assets that are

too old are holding them back from expanding their business.

More than two-fifths (42%) of respondents said they need more capital assets (such

as operational equipment, vehicles and computer hardware) to grow their business,

followed by 26 per cent that said their assets are too old and need to be updated.

Is a lack of capital assets holding your business from

growing further?

By State.

Almost half (46%) of NSW businesses stated that they would need more capital

assets to grow further. This was followed by:

- 44% of respondents from Western Australia

- 41% for respondents from Victoria

- 41% of respondents from Queensland

- 27% of respondents from South Australia

Furthermore, two-fifths (40%) of South Australian businesses said their capital

assets are too old and need updating. Thirty-eight (38) per cent of businesses in

Western Australia said the same, followed by 26 per cent of Victorian businesses, 25

per cent of businesses in NSW and 19 per cent of businesses in Queensland.

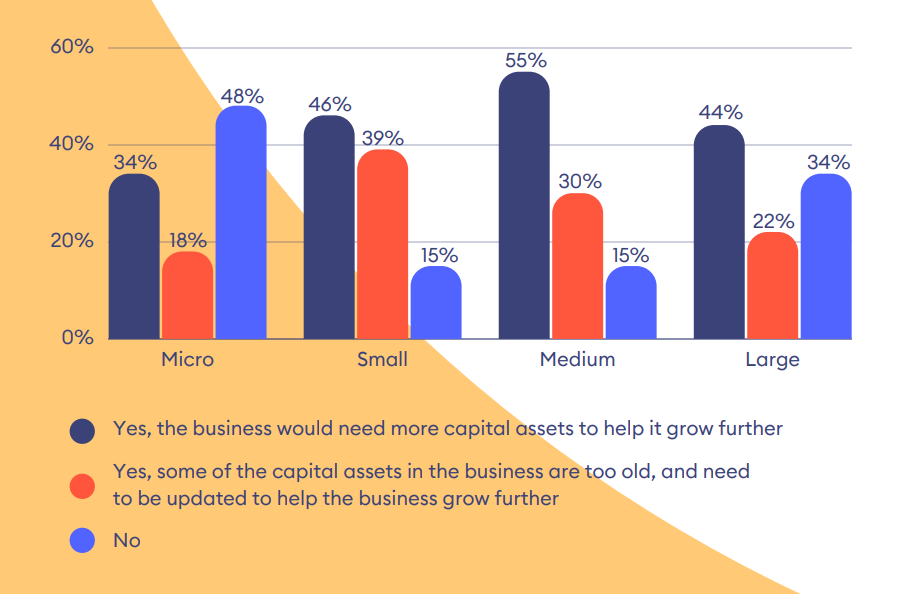

Is a lack of capital assets holding your business back from

growing further?

By business size.

Across business sizes, more than half (55%) of medium sized businesses need capital

assets to help grow further. This compares with only 46 per cent of small businesses,

followed by 44 per cent of large businesses and 34 per cent of micro businesses.

Thirty-nine (39) per cent of small businesses surveyed said that aging and obsolete

capital assets are to blame for stagnant business growth. This is followed by almost

a third (30%) of medium-sized businesses, 22 per cent of large businesses and 18 per

cent of micro businesses.

Almost half (48%) of micro businesses do not require capital assets to support their

business growth. This is followed by:

- 34% of large businesses

- 15% of medium-sized businesses

- 15% of small businesses

Is a lack of capital assets holding your business back from

growing further?

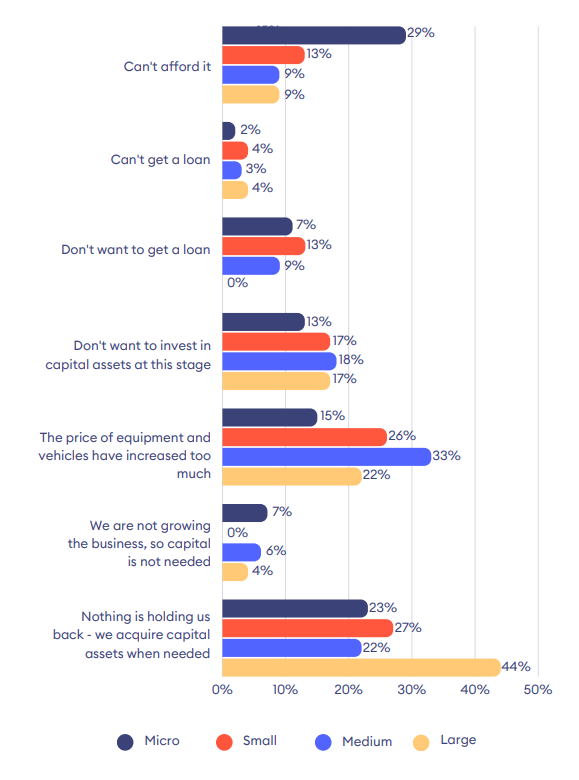

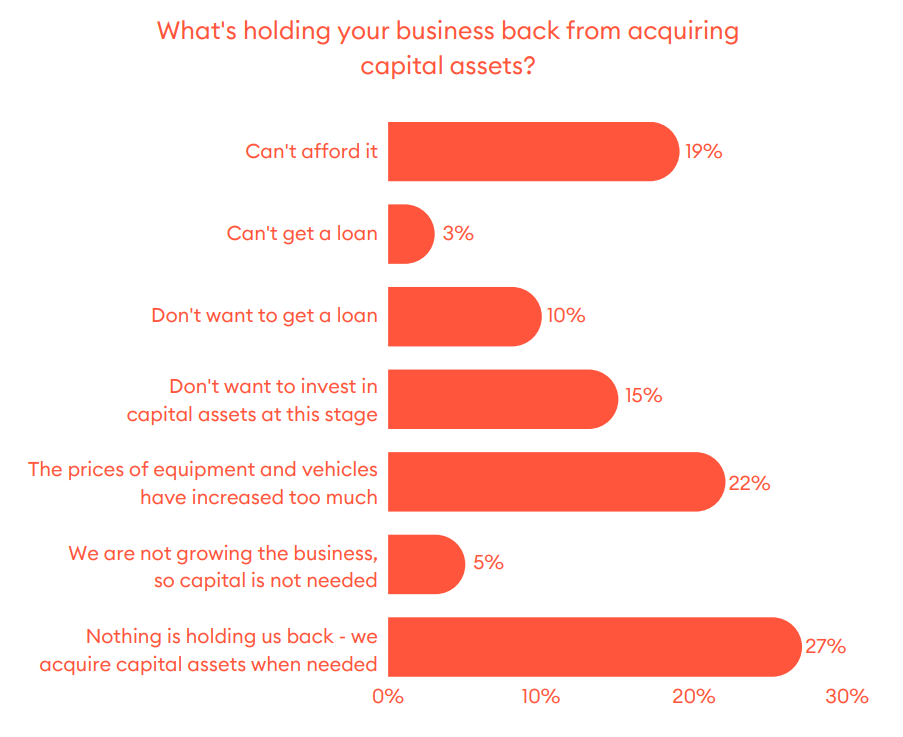

What is holding businesses back from acquiring

capital assets?

The most common factor that is preventing businesses from acquiring capital assets

is the increased price of equipment and vehicles, with almost a quarter (22%) of

respondents saying so. Almost a fifth (19%) of businesses said they can’t afford

capital assets at this time and 15 per cent don’t want to invest at this stage.

More than a quarter (27%) of respondents said that nothing is holding their

businesses back from acquiring new capital assets to expand.

Reassuringly for finance lenders and businesses, only 3 per cent reported being

unable to secure a loan to support their business growth.

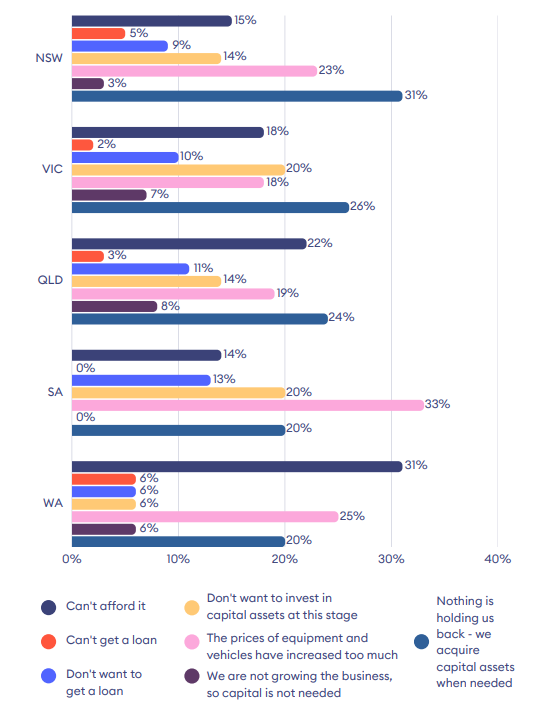

By State.

A third (33%) of South Australian businesses said the increasing price of equipment

and vehicles was preventing them from acquiring capital assets. A quarter (25%) of

West Australian businesses reported the same, followed by, 23 per cent of NSW

businesses, 19 per cent of Queensland businesses and 18 per cent of Victorian

businesses.

The study found 31 per cent West Australian businesses are unable to afford capital

assets. This was followed by:

- 22% from Queensland

- 18% from Victoria

- 15% from NSW

- 14% from South Australia

Almost a third (31%) of NSW businesses said they were not held back from acquiring

capital assets and can acquire them when needed. This compares with 26 per cent

from Victoria, 24 per cent from Queensland, 20 per cent from South Australia and

20 per cent from Western Australia.

Twenty (20) per cent of Victorian and South Australian businesses said they don’t

want to invest in capital assets at this stage. This is followed by Queensland and

NSW, at 14 per cent. Six (6) per cent of West Australian businesses reported that they

don’t want to invest in capital at this stage.

What’s holding your business back from acquiring

capital assets?

By business size.

A third (33%) of medium-sized businesses reported that equipment and vehicle

prices have increased too much. This compares with a quarter (26%) of small

businesses, followed by 22 per cent of large businesses and 15 per cent of micro

businesses.

Micro businesses are most likely to report being unable to afford acquiring capital

assets, with almost a third (29%) saying so. This compares with:

- 13% of small businesses

- 9% of medium-sized businesses

- 9% of large businesses

Almost half (44%) of large businesses face no hindrance in acquiring capital assets

as needed. This compares with 27 per cent of small businesses, 23 per cent of micro

businesses and 22 per cent of medium-sized businesses.